IMAGE SOURCE : LAWGICAL SEARCH@ COPYRIGHT

Introduction—Fundamental Concept under the Company Law:

Under the Indian Company Law framework, the powers of management and decision-making are primarily divided between two governing bodies:

the Board of Directors (Board) and,

the Shareholders.

While the Board exercises its powers through Board Meetings, and the Shareholders assert their rights and take significant decisions in General Meetings, such as Annual General Meetings (AGMs) and Extraordinary General Meetings (EGMs).

General Powers of the Board:

Under Section-179(1) of the Companies Act, 2013, a general power has been conferred on the Board of Directors.

“The Board of Directors of a Company shall be entitled to exercise all such powers, and to do all such acts and things, as the Company is authorised to exercise and do.”

First proviso to this section states that in exercising such power or doing such act or thing, the Board shall be subject to the provisions contained in that behalf in this Act, or in the memorandum or articles, or in any regulations not inconsistent therewith and duly made thereunder, including regulations made by the company in general meeting.

In general words:

When the Board of Directors uses its powers or makes any decision on behalf of the company, it must follow the rules and restrictions given in:

- the Companies Act itself,

- the company’s Memorandum of Association (MoA),

- the company’s Articles of Association (AoA), and

- any regulations or rules including regulations passed by the company in its general meetings, as long as those rules are not against the law.

Powers reserved for Shareholders:

Second proviso to Section-179(1) restricts the power of Board of Directors to do things which are specifically required to be done by Shareholders in the General Meetings.

Some of the acts which are specifically required to be done by shareholders are as follows:

- Alteration in MoA/AoA

- Increase in Authorized Share Capital

- Reduction of Share Capital

- Further issue of Capital (Private Placement/Bonus Issue etc.)

- Appointment of Directors/Auditors

Note to the Reader:

This article focuses exclusively on the distinction between Ordinary and Special Business and Ordinary and Special Resolutions under the Companies Act, 2013. Related topics such as the Powers of the Board and Shareholders, Board Meetings, and General meetings will be discussed in detail in separate articles.

Shareholders are the ultimate owners of a company, and they assert their rights and take significant decisions in General Meetings.

General Meeting also called as Shareholders Meeting. A general meeting of the Company is a formal gathering of Shareholders to discuss and decide the important matters of the Company. It can either be an Annual General Meeting (AGM) or an Extra-Ordinary General Meeting (EGM).

Annual General Meeting:

AGMs are mandatory for all companies other than One Person Companies, and are held to discuss routine annual matters like adoption of financial statements, declaration of dividends, and appointment/reappointment of directors and auditors.

According to Section-96(1) of the Companies Act, 2013, every company, whether public or private, except One Person Company (OPC), shall hold an Annual General Meeting (in addition to any other meetings i.e. General Meeting) in each calendar year and the Notice calling it shall specify the meeting (i.e. AGM) further the gap between two AGMs should not be more than 15 months.

Extra-Ordinary General Meeting:

EGMs are called as and when needed to discuss urgent or non-routine matters that cannot wait until the next AGM. These meetings usually involve special business items, such as:

- Alteration of Articles of Association,

- Approval of major transactions (e.g., mergers or acquisitions), or

- Changes in the capital structure.

Section-100 of the Companies Act, 2013 deals with Extra-Ordinary General (EGM). It states that the Board may also, whenever it deems fit, call an Extra-Ordinary General Meeting of the company.

Classification of Business and Resolutions under the Companies Act:

While General Meetings provide a platform for shareholders to participate in key decisions, not all matters brought before such meetings are the same under the law. The Companies Act, 2013 introduces a clear classification system to ensure that decisions are made with the appropriate level of scrutiny and shareholder approval.

To maintain procedural clarity, and to ensure that both routine and significant matters are handled with the appropriate level of attention, the law divides the items taken up in a general meeting into two major categories:

Classification of Business:

- Ordinary Business

- Special Business

Simultaneously, the manner in which decisions are approved, that is, the type of resolution required to be passed is also classified:

Classification of Resolutions:

- Ordinary Resolution

- Special Resolution

Why This Classification Matters:

The classification of business and resolutions in general meetings is not just a formality, it plays a vital role in ensuring procedural compliance and maintaining transparency in decision making.

Each category, whether it is Ordinary or Special Business, or an Ordinary or Special Resolution, comes with its own procedural requirements, such as:

Explanatory Statements:

- For Special Business, the law mandates the inclusion of an explanatory statement under Section-102(1) of the Companies Act, 2013.

- This statement must clearly set out the material facts, nature of the transaction, interest of directors, and any other relevant information that ensures shareholders are making informed decisions and are fully aware of the implications of the resolution.

Type of Notice:

- The classification also impacts the content and nature of the notice sent to shareholders.

- For Special Resolutions, the intention to pass it as a Special Resolution must be clearly stated in the notice itself.

Voting Threshold:

The level of approval required varies depending on the classification:

- An Ordinary Resolution passes with a simple majority (i.e. vote caste in favour of resolution exceeds the votes cast against the resolution if any).

- A Special Resolution passes with a special majority (i.e. the votes cast in favour of the resolution, are required to be not less than three times the number of the votes, if any, cast against the resolution by members so entitled and voting.)

The Bigger Picture: Compliance & Governance:

- Understanding and correctly applying these classifications is essential for:

- Ensuring legal validity of resolutions,

- Avoiding penalties or litigation due to procedural lapses, and

- Upholding the principles of good corporate governance and shareholder democracy.

- Non-compliance with these procedural safeguards can lead to void resolutions, regulatory scrutiny, or loss of investor trust.

Ordinary Business vs Special Business – A Legal Distinction That Matters:

In every General Meeting, whether it is an Annual General Meeting (AGM) or an Extraordinary General Meeting (EGM), various items of business(s) are brought before shareholders for their approval. But under the Companies Act, 2013, not all business(s) are treated equally.

To maintain procedural clarity and ensure that shareholders are informed and involved appropriately, the Act classifies business(s) that are transacted in general meetings into two categories:

- Ordinary Business

- Special Business

Let’s explore what each of these means:

Ordinary Business:

Under the Companies Act, 2013, “Ordinary Business” refers to the routine matters that are typically transacted at an Annual General Meeting (AGM) of a Company.

As per Section-102(2) of the Companies Act, 2013, the following are considered Ordinary Business, but only when conducted at an Annual General Meeting (AGM) of the Company:

- the consideration of financial statements and the reports of the Board of Directors and auditors;

- the declaration of any dividend;

- the appointment of Directors in place of those retiring;

- the appointment of, and the fixing of the remuneration of, the auditors.

Accordingly, the four above specified matters, when transacted at an Annual General Meeting, are deemed Ordinary Business and any additional item taken up at the same AGM is regarded as Special Business.

Further if any of the above-mentioned items are transacted in an EGM instead of an AGM, they are treated as Special Business.

Hence to conclude in the case of any Extra-Ordinary General Meeting, all the business(s) shall be deemed to be Special Business without exceptions.

The table below illustrates this difference with practical examples-

| S. No. | Item of Business | Meeting Type | Business Classification | Type of Resolution | Explanatory Statement Required? |

| 1 | Approval of Financial Statements | AGM | Ordinary Business | Ordinary Resolution | No |

| 2 | Approval of Financial Statements | EGM | Special Business | Ordinary Resolution | Yes |

| 3 | Appointment of Statutory Auditors | AGM | Ordinary Business | Ordinary Resolution | No |

| 4 | Appointment of Auditor in Casual Vacancy | AGM | Special Business | Ordinary or Special (as per Act) | Yes |

| 5 | Declaration of Dividend | AGM | Ordinary Business | Ordinary Resolution | No |

| 6 | Declaration of Dividend | EGM | Special Business | Ordinary Resolution | Yes |

| 7 | Appointment of Director (other than retiring) | AGM or EGM | Special Business | Ordinary or Special (as per Act) | Yes |

| 8 | Alteration of Articles of Association | AGM or EGM | Special Business | Special Resolution | Yes |

| 9 | Shifting Registered Office outside city limits | AGM or EGM | Special Business | Special Resolution | Yes |

| 10 | Issue of Bonus Shares | AGM or EGM | Special Business | Ordinary Resolution | Yes |

| 11 | Issue of Shares via Private Placement | AGM or EGM | Special Business | Special Resolution | Yes |

| 12 | Buy-back of Shares | AGM or EGM | Special Business | Special Resolution | Yes |

| 13 | Change in MD’s Remuneration | AGM or EGM | Special Business | Ordinary or Special (as per Act) | Yes |

| 14 | Adoption of Employee Stock Option Plan (ESOP) | AGM or EGM | Special Business | Special Resolution | Yes |

Special Business:

As per Section-102(2) of the Companies Act, 2013, any business transacted at a general meeting of a company that is not classified as Ordinary Business is treated as Special Business.

Special Business in general refers to those matters which are not part of the routine, day-to-day operations of a company and usually involve significant or strategic decisions that may have a long-term impact on the company’s structure, capital, or governance.

Special Business may be conducted at both Annual General Meetings (AGMs) and Extraordinary General Meetings (EGMs). However, it is important to note that all business transacted at an EGM is, by default, classified as special business without any exception.

Examples of Special Business:

- Alteration of the Memorandum or Articles of Association,

- Shifting of the registered office from one state to another,

- Issue of shares through private placement or bonus shares,

- Buy-back of securities

- Giving loans, guarantees, or investments under Section 186

Important mandatory requirements for Special Business:

Explanatory Statement [Section 102(1)]:

Every item of Special Business must be accompanied by an Explanatory Statement in the notice of the general meeting. This statement should clearly disclose:

The nature of the business and reasons for the proposal;

- Material facts relevant to the matter;

- Any interest of directors, key managerial personnel (KMP), or promoters;

- Other details necessary for shareholders to make an informed decision.

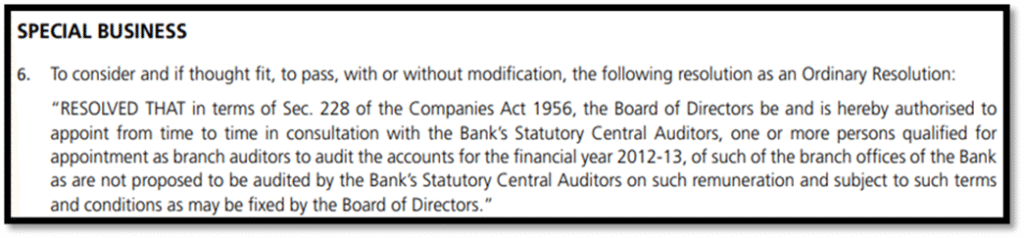

Each item of Special Business must be in the form of Resolution in the Notice:

According to the Secretarial Standard SS-2 – In respect of items of Special Business, each such item shall be in the form of a Resolution and shall be accompanied by an explanatory statement which shall set out all such facts as would enable a Member to understand the meaning, scope and implications of the item of business and to take a decision thereon.

Example:

In case of Special Business each item shall be in the form of Resolution such as:

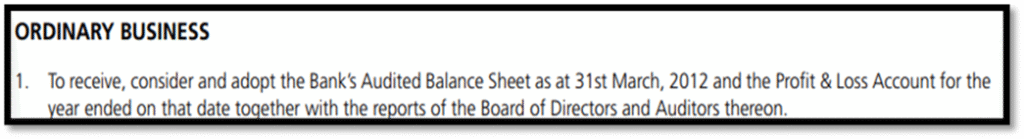

However, in respect of items of Ordinary Business, Resolutions are not required to be stated in the Notice.

Example:

Important differences between Ordinary and Special Business:

| Item | AGM | EGM | Explanatory Statement Required |

| Approval of Financials | Ordinary | Special | No (AGM), Yes (EGM) |

| Alteration of AoA | Special | Special | Yes |

| Appointment of new director | Special | Special | Yes |

| Dividend Declaration | Ordinary | Special | No (AGM), Yes (EGM) |

Don’t Confuse “Business” with “Resolution”

It’s important to clearly distinguish between the terms “Ordinary Business” vs “Special Business” and “Ordinary Resolution” vs “Special Resolution” as they are not the same and should not be used interchangeably.

The classification of business (Ordinary or Special) is relevant only for the purpose of determining whether an explanatory statement is required under Section-102 of the Companies Act, 2013.

It does not determine the type of resolution to be passed.

Whether a company needs to pass an Ordinary Resolution (OR) or a Special Resolution (SR) is entirely based on what the Act prescribes for that specific matter.

If the Act simply states that “a resolution” is to be passed in the general meeting, it refers to an Ordinary Resolution.

If it is specifically mentioned that the act must be done by a Special Resolution, then only a Special Resolution is required.

What is Resolution?

A resolution is the formal decision passed at a meeting of Shareholders or Board of Directors. It’s a legally binding decision that outlines the company’s course of action. Resolutions are typically proposed as motions, and they become binding after being passed by the required majority of members.

Section-114 of the Companies Act, 2013 recognises two types of resolutions passed at General Meetings:

Ordinary Resolution

Special Resolution

Motion vs Resolution:

Under the Companies Act, a motion is a proposal made at a meeting for discussion and decision, while a resolution is the formal decision or expression of opinion reached after the motion is passed by a required majority. In essence, a motion is the proposal, and a resolution is the formal outcome of that proposal once it’s approved.

A motion becomes a resolution only after the requisite majority of members have adopted it. A motion should be in writing and signed by the mover and put to the vote at the meeting by the chairman.

Understanding of Ordinary Resolution & Special Resolution:

Ordinary Resolution [Section 114(1)]:

In simple terms, an Ordinary Resolution is one that passes when:

“The votes cast in favour of the resolution are more than the votes cast against it.”

This means it passes with a simple majority (i.e., over 50% of the shareholders who are present and voting [either in person or by proxy] must approve it.

But What Does the Law Actually Say?

Let’s refer to the Bare Act – Section 114(1) of the Companies Act, 2013, which defines an Ordinary Resolution:

A resolution shall be an ordinary resolution if the notice required under this Act has been duly given and it is required to be passed by the votes cast, whether on a show of hands, or electronically or on a poll, as the case may be, in favour of the resolution, including the casting vote, if any, of the Chairman, by members who, being entitled so to do, vote in person, or where proxies are allowed, by proxy or by postal ballot, exceed the votes, if any, cast against the resolution by members, so entitled and voting.

Based on the explanation above, two essential conditions must be satisfied for a resolution to qualify as an Ordinary Resolution under the Companies Act, 2013:

- Proper Notice:

The company must have given due notice in terms of the provisions of Section-101 of the Companies Act, 2013 to all members and other persons, as required by the law.

- Voting Majority:

At the time of voting — whether conducted:

by show of hands,

electronically, or

through a poll,

the votes cast in favour of the resolution (including the casting vote, if any, of the Chairman) by the members (who is entitled to present and vote in meeting including by proxy) must exceed the votes cast against it.

🔍 Why is this Explanation Important?

Because if any of the essential conditions outlined above are not fulfilled then:

- the resolution will not be considered valid, and

- it will have no legal force or binding effect on the company.

Special Resolution [Section 114(2)]:

In simple terms, a Special Resolution is more stringent and it is passed when:

“The votes cast in favour of resolution are at least three times the number of votes cast against resolution.”

This translates to a 75 or more % majority requirement among those who present (either in person or through proxy) and voted.

But What Does the Law Actually Say?

Let’s refer to the Bare Act – Section 114(2) of the Companies Act, 2013, which defines a Special Resolution:

A resolution shall be a special resolution when—

- the intention to propose the resolution as a special resolution has been duly specified in the notice calling the general meeting or other intimation given to the members of the resolution;

- the notice required under this Act has been duly given; and

- the votes cast in favour of the resolution, whether on a show of hands, or electronically or on a poll, as the case may be, by members who, being entitled so to do, vote in person or by proxy or by postal ballot, are required to be not less than three times the number of the votes, if any, cast against the resolution by members so entitled and voting.

Thus, based on the explanation above a resolution is considered a Special Resolution only when all three of the following conditions are met:

- Clear Intention Stated in the Notice:

The company must clearly mention in the notice (or any other communication to members) that the proposed resolution is required to be pass as Special Resolution.

- Proper Notice Given:

The notice of the meeting must be duly given in accordance with the Section-101 of the Companies Act — including the required number of days before the meeting and the manner of delivery (physical, electronic, etc.).

- Voting Threshold is Met:

When the resolution is put to vote (either by show of hands, electronically, on a poll, or postal ballot as the case maybe) — the number of votes cast in favour of resolution (by the members entitled to vote either in person, by proxy or through postal ballot) must be at least three times the number of votes cast against the resolution.

This means at least 75% or more of the votes cast must be in favour for it to pass as a special resolution.

Why is this Explanation Important?

If any of the three essential conditions for passing a Special Resolution are not fulfilled then:

- the resolution will not be treated as a valid Special Resolution, and

- it will have no legal force or binding effect on the company.

For Example:

Suppose a company sends out a notice stating:

“If thought fit, the following resolution will be passed as an Ordinary Resolution or Just Resolution.”

This fails the first requirement — which mandates that the notice must clearly specify the intention to pass the resolution as a Special Resolution.

As a result, even if shareholders approve it with a 3:1 majority (i.e. 75% or more votes cast in favour), the resolution will not qualify as a Special Resolution, and any actions taken based on it could be legally challenged.

Frequently Asked Questions:

Q1. Can an Ordinary Business require Special Resolution?

No. Ordinary Business refers to routine matters and doesn’t require Special Resolution unless the Act or any Regulations requires that.

Further whether a company needs to pass an Ordinary Resolution (OR) or a Special Resolution (SR) is entirely based on what the Act prescribes for that specific matter.

Q2. Can a Special Business be transacted via Ordinary Resolution?

Yes, if the Companies Act doesn’t mandate Special Resolution for it.

As mentioned earlier, whether a company needs to pass an Ordinary Resolution (OR) or a Special Resolution (SR) is entirely based on what the Act prescribes for that specific matter.

Q3. Can I club Ordinary and Special Business in the same meeting?

Yes, in Annual General Meeting. Both Ordinary Business and Special Business can be transacted.

Q4. Can Ordinary Business be transacted in EGM Meeting?

No, In the case of any Extra-Ordinary General Meeting, all the business(s) shall be deemed to be Special Business without exceptions.

Q5. Do we need to pass OR in case of Ordinary Business and SR in case of Special Business?

No, whether a company needs to pass an Ordinary Resolution (OR) or a Special Resolution (SR) is entirely based on what the Act prescribes for that specific matter.

The classification of business (Ordinary or Special) is relevant only for the purpose of determining whether an explanatory statement is required under Section-102 of the Companies Act, 2013.

It does not determine the type of resolution to be passed.

Conclusion:

In Company Law, the distinction between Ordinary vs Special Business and Ordinary vs Special Resolution ensures procedural clarity and legal compliance. While the classification of business determines whether an Explanatory Statement is required, the classification of resolutions determines the voting threshold and legal effect of the decision being taken.

Always Know the “What” & the “How”

- What is being done? → That’s your Business (OB/SB)

- How is it being passed? → That’s your Resolution (OR/SR) – Which the Act specifically prescribes.

Keep this framework in mind to ensure:

- Legal compliance

- Proper ROC filings

- Avoidance of penalties

- Respect for shareholder rights

Practical Tip:

All SRs are for Special Business, but not all Special Business needs SR.

Some Special Business can be done with an OR, based on the Act.

Written by Mahboob Gaddi and Farman Ahmad | Founders, Lawgical Search